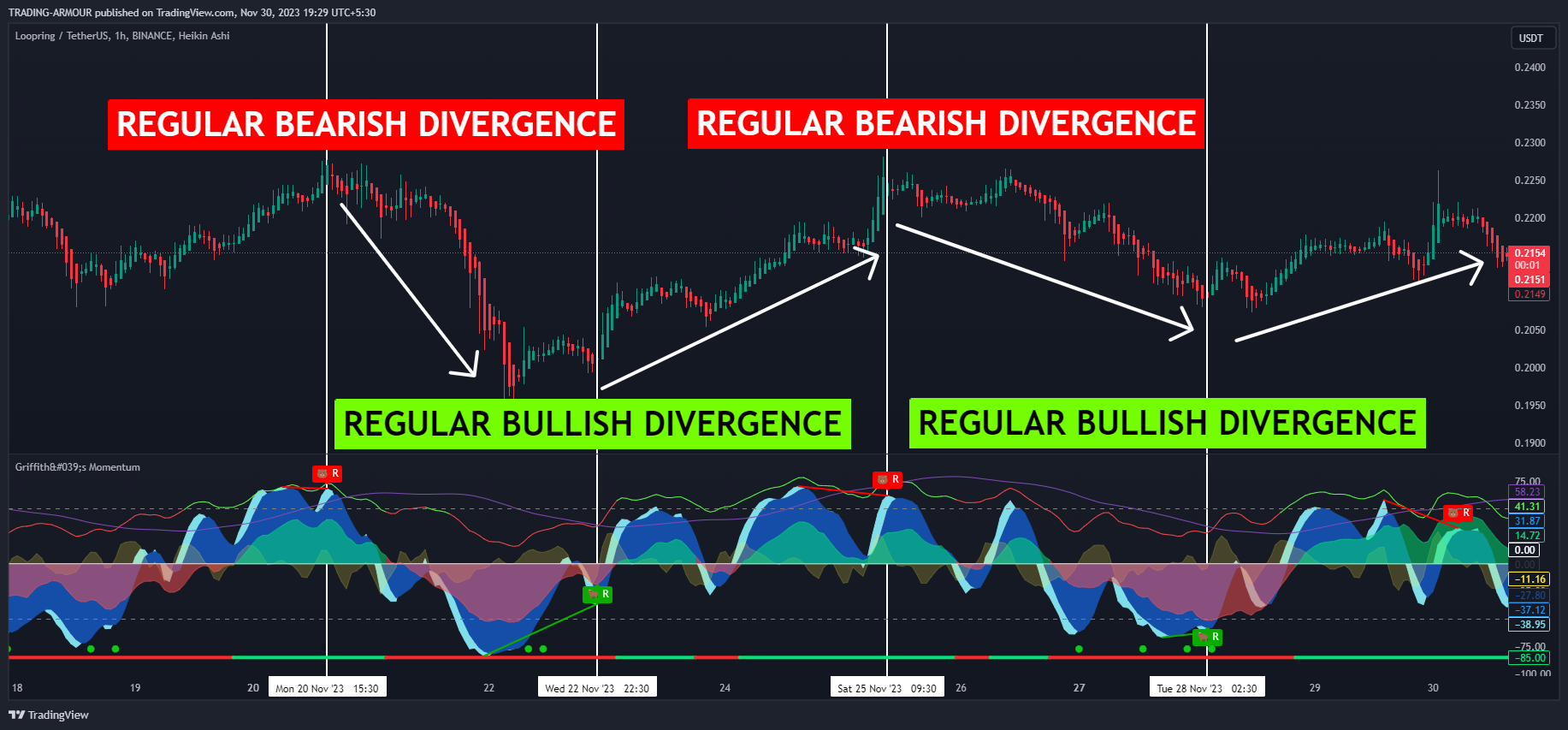

Best way to Identify how Divergences could signal a potential Reversal.

In the world of trading, how divergences could signal a potential Reversal? Two widely used indicators, the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD), provide insights into market dynamics. As traders, understanding any divergences between these indicators and price can be paramount to making informed investment decisions. In this blog post, we will explore the significance of divergences and how they can potentially signal a market shift.

To get These Automatic Divergence Indicators visit this website https://www.tradingarmour.com/

Understanding the Relative Strength Index (RSI):

The RSI, a popular momentum oscillator, indicates whether an asset is overbought or oversold. By measuring the strength of price changes, it provides traders with valuable insights. However, divergence between the RSI and price can be a strong indication of an upcoming market shift. When prices reach new highs, but the RSI fails to reach similar levels, it suggests underlying weakness. Conversely, when prices reach new lows, but the RSI fails to exhibit similar behavior, it indicates potential market strength.

Exploring the Moving Average Convergence Divergence (MACD):

The MACD, another widely used technical indicator, provides insights into trend momentum. It consists of two lines, the MACD line and the signal line, along with a histogram that represents the difference between them. While the MACD focuses on convergence and divergence of moving averages, it can also exhibit divergences with price. A bearish divergence occurs when prices reach higher highs, but the MACD fails to follow suit, suggesting a potential market reversal. Conversely, a bullish divergence occurs when prices reach lower lows, but the MACD shows higher lows, potentially signaling a market upturn.

Significance of Divergences:

Divergences between price and momentum indicators can be powerful signals of an impending market shift. They suggest underlying weaknesses or strengths that may not be evident from price movements alone. Spotting these divergences can help traders anticipate and react to potential market reversals, allowing them to adjust their positions ahead of time and minimize risks.

Conclusion:

As traders, understanding the divergences between price and momentum indicators like the RSI and MACD is essential. These indicators’ ability to showcase underlying market strengths or weaknesses can provide valuable insights for making informed investment decisions. By incorporating the analysis of divergences into their trading strategies, traders can better navigate the market and potentially capitalize on emerging opportunities. Stay vigilant, be aware of divergences, and equip yourself with the knowledge to stay ahead of market shifts. Happy trading!